Wall Street’s Pitiful Bitch

It doesn’t get more pathetic than this. After the Fed’s “disappointing†25 basis point rate cute, divided FOMC vote and failure to guarantee more cuts just around the corner, Pusillanimous Powell saw the markets barfing and therefore stumbled forth with the following 20-word ignition switch:

It is certainly possible that we’ll need to resume the organic growth of the balance sheet sooner than we thought.â€

And then the algos were off to the races the moment Powell implicitly confirmed that QE4 is indeed on the way. At exactly 2:50pm stocks spiked and the dollar slumped.

So there can no longer be any doubt at all that the Mighty Fed has been reduced to the status of Wall Street’s pitiful bitch and that the Donald might as well fire Chairman Powell and replace him with, well, a weathervane.

After all, it doesn’t get more equivocal than this:

Peak Trump: The Undrai…

Best Price: $13.58

Buy New $20.46

(as of 06:50 EDT – Details)

“There will come a time, I suspect, when we think we’ve done enough. But there may also come a time when the economy worsens and we would then have to cut more aggressively,†said Mr. Powell at a news conference Wednesday. “We don’t know.â€

He got that right. The Fed heads have no idea what they are doing – so they are taking their cues from the most greedy, aggressive traders on Wall Street who believe the Fed owes them nothing less than a stock market which rises every single day.

That is to say, hyped-up on massive leverage through publicly traded options and privately bespoke structured trades, their level of entitlement, greed and recklessness knows no bounds.

So when the Fed chairman confesses “we don’t know†what he actually means is the Keynesian fools in the Eccles Building don’t know they have become virtual captives of the speculative mania now loose in the financial markets.

After all, it’s plain as day that a 25 bps rate cut or $75 billion overnight TOMO loan (temporary open market operation) to Wall Street dealers would be of no benefit to the main street economy whatsoever; and that when it comes to countering the global headwinds emanating from the world’s $85 trillion trade war rattled economy, which Powell mentioned repeatedly at his presser, they might as will be pissing into the wind.

So why did the Fed panic into supplying $75 billion of overnight TOMO to the dealer markets in the last two days consecutively if such accommodation obviously had nothing to do with its dual mandate regarding main street price stability and maximum employment?

Most assuredly it is not because of a liquidity shortage in the inter-bank markets. The latter are still sitting on $1.35 trillion of excess bank reserves deposited at the Fed and useable at a moments notice. So if any bank is really short, a slight rise in the effective federal funds rate would have easily resolved the pressure.

But the reason the GC (general collateral) repo rate has soared to as high as 10% this week – besides the seasonal pressure owing to Q3 corporate tax payments and the US Treasury’s $150 billion cash replenishment drive – is that traders and speculators are stepping up their efforts to fund yield curve and other technical trades/speculations in the repo market, thereby driving up the scarcity value of such collateral.

According to Bloomberg, a crowded gamble at the moment is 2s/10s steepeners in which traders short the 10-year and fund a oversized long-position in the two-year note with repo. Essentially, it’s a capital-free trade (i.e. nearly all the long side funding is borrowed) in which gamblers will laugh all the way to the bank if their bet is correct and simply unwind it if the curve steepening doesn’t materialize.

However, this lucrative trade is thrown into a cocked hat if Wall Street gamblers have to pay 10% for the repo to fund the long-side of their bet.

So the fools in the Eccles Building came charging to the rescue with an overnight TOMO for the purpose of stabilizing the money markets and enforcing their misbegotten peg on the Federal funds rate. Yet the latter is now only a tiny part (@$75 billion) of the multi-trillion money market because the Fed destroyed the old fashioned fed funds market when it pumped nearly $3.5 trillion of fiat credit into the banking system under QE.

Accordingly, the banks are drowning in excess liquidity. The historical benchmark price for overnight money in the interbank market (i.e. fed funds) is merely a vestigial relic and is essentially pinned at the Fed’s target rate by the stupidity of paying banks upwards of $45 billion per year to keep funds parked under the IOER umbrella. Moreover, upwards of 60% of Fed funds trading is actually attributable to the speculative activities of the government-backed Federal Home Loan banks.

Needless to say, the much larger repo and funding markets outside of the eligible inter-bank markets have a mind of their own and are now struggling to price overnight funding at a high enough level to clear the decks by attracting new funding and depressing speculative demand.

So what have our Keynesian fools done in the last few days?

Why, they have flooded the repo market with overnight credit plucked from thin air to make it “behaveâ€, thereby providing another gift that never stops giving to the speculators who are delighted to be paying about 2.3% this afternoon rather than 10% to fund their latest gambles.

That is, there was nothing technical or necessary about these giant TOMOs – they were just another bailout of Wall Street speculators who were temporarily on their back-foot.

Needless to say, if you bailout speculators, they will simply speculate more. And if you do it over and over and predictability so, you will positively destroy two-way markets in the interior of the financial system and extinguish the fear of risk and loss, which is the only thing which keeps the speculative impulses in check.

Nor are we referring merely to the Fed’s beneficent impact on arcane speculations like the 2s/10s steepener trade. The 25 basis point rate cut announced yesterday had only one purpose and a single function: Namely to keep the broad market averages rising at the behest of stock speculators and the trillions of passive/indexed funds which kite on the relentless rise of the market and sub-market averages.

Indeed, the Wall Street Journal on Thursday AM noted that the Wall Street levitation machine has become insuperable, and now packs more firepower than all of the stock-picking, active manager gurus combined.

Money managers that mimic the stock market just became the new titans of the fund-management world.

Funds that track broad U.S. equity indexes hit $4.27 trillion in assets as of Aug. 31, according to research firm Morningstar Inc., giving them more money than stock-picking rivals for the first-ever monthly reporting period. Funds that try to beat the market had $4.25 trillion as of that date.

Needless to say, the three giant proprietors of the index and ETF dollars represented by the black line on the chart above – Black Rock, State Street and Vanguard – are tickled pink by the Fed’s price-keeping operations and are never at a loss for advice on reasons why it needs do more.

In a word, after 10-years of QE and massive bond-buying, the Fed’s policies have lost any connection to the main street economy: They simple liquefy Wall Street and fund increasingly arcane, unstable and egregious forms of stock, bond and derivatives speculation that requires ever more central bank support – least the great bubbles of Wall Street collapse, thereby triggering an eruption of desperate “restructuring†maneuvers in the C-suites.

The plain word for the latter is recession – the main street consequence of a sudden liquidation of hoarded labor, excessive inventories, underperforming fixed assets and other balance sheet mutations which are the progeny of easy money, and which actions swiftly bring down the main street economy as well.

It goes without saying, of course, that the Keynesian central bankers running the Fed have now lost all contact with sound money, and even economic sanity for that matter. After all they are positively taking Einstein at his word and doing the same thing over and over while expecting a different result.

This time they claim to be boosting a recovery which is facing intensifying global headwinds and taking out “insurance†just in case recessions haven’t been abolished after all. But it’s the same old hammer – interest rate cuts – looking for a monetary nail called “accommodation†that is essentially a figment of Fed group think.

That is to say, a 1.87% effective fed funds rate (between the new 1.75%-2.0% target range) will have no impact whatsoever on main street because the latter does not use overnight funds. Wall Street does, and mainly to fund the gambling addiction of its speculators and high rolling hedge funds.

So by pushing the Fed funds rate down by 25 basis points during month #121 of the longest business expansion in history and when the U-3 unemployment rate is at a 50-year low (3.7%) the Fed heads are essentially saying that money needs no price, and that they will just keep pounding that monetary nail come hell or high water.

The Great Deformation:…

Best Price: $4.95

Buy New $13.62

(as of 11:20 EDT – Details)

Yet this incessant easing action is not merely a matter of zero effectiveness on main street – a monetary tree falling in an empty forest, as it were.

That’s because the Fed’s relentless monetary repression and massive debt monetization are about as efficacious as it gets when it comes to Wall Street. Cheap overnight money is the mother’s milk of carry trade speculation, and the Fed’s policy for more than a decade has been to drive the money market rate below the inflation rate, thereby making the cost of carry negative in real terms.

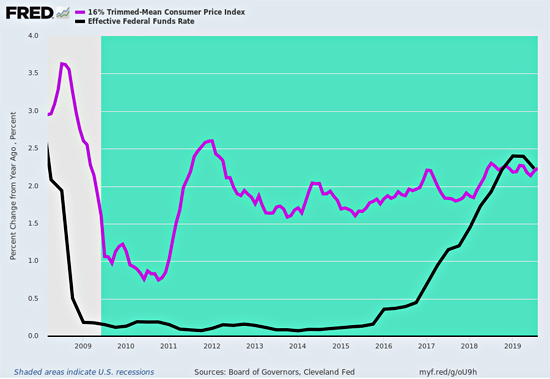

As shown in the chart below, in April 2008 the Fed lowered the funds rate to 2.0% in a desperate efforts to bolster an main street economy which was already in recession, even though the 12 FOMC geniuses managing the economy had no clue at the time.

In any event, the 12-month inflation rate was then 2.95%, meaning that the cost of money market funds on main street was now a full point below the inflation rate and the gap only got wider from there.

By January 2012, for instance, the Fed funds rate was still down on the floorboard at a mere 10 basis points, while the trailing 12-month inflation rate posted at 2.60%, meaning that the real (inflation-adjusted) cost of money was -2.50%.

The Wall Street traders literally thought they had died and gone to heaven.

As is evident in the chart, finally in December 2018 did the Fed get the effective funds rate a hair above the inflation rate – only to have Pusillanimous Powell pivot within days owing to the loud barking from the Oval Office and the plunging stock averages of Christmas Eve massacre.

At length, and 137 months from the original April 2008 break, we are back under water with the Fed’s money market target rate of 1.87% well below the 2.19% trailing rate of inflation as measured by the very stable and reasonably accurate 16% trimmed mean CPI.

Of curse, there is only one place 137 months of negative real money rates can lead. Namely, to the mother of all stock market bubbles and the greatest bust ever.

Yesterday’s 10% spike in the repo rate is undoubtedly a warning of the financial market turmoil directly ahead. The Fed has fueled a monster and now it cluelessly hangs on for dear-life – resorting to ever more mindless maneuvers to keep the monster at bay.

As Sven Heinrich observed,

To me this is just another sign how fragile things really are. Everything is dependent on this construct being actively managed. Don’t let the forces of supply and demand find a natural price equilibrium, intervene. Straight away. And so what this will end up being? A $100B to $130B liquidity injection in just 2 days? This is what it takes to keep the wheels from falling off.

Actually, it is worse than that. The Fed heads are so obsessed with enforcing their Fed funds target in order to show they still rule the financial system that they fail to see the warning signs flashing before their very eyes.

To wit, the apparent unsatisfied demand for “liquidity†that caused the repo rate to hit 10% is simply a measure of the degree to which carry trade speculation has reached a fever pitch. The gamblers need more and more repo because that’s how they fund their speculative positions.

Moreover, this is occurring exactly at the moment that the Donald and his merry band of bipartisan borrow and spending politicians on Capitol Hill have driven Uncle Sam’s funding requirements over the $1 trillion mark – with no end in sight to the rising tide of late cycle red ink.

Of course, there is a ready solution. Shutdown the FOMC and let free market interest rates clear the decks. That would send the carry trade speculators of Wall Street to the showers and the politicians of Washington to the fiscal sobriety clinics.

Nor would main street be worse for the wear. What’s going on now will bring down the house anyway.

PEAK TRUMP, IMPENDING CRISES, ESSENTIAL INFO ACTION

Trump-O-Nomics is pushing the global economy into a 30-year storm America’s not prepared. My new book debunks both Washington Wall Street BS outs the real culprits: the Deep State, the Fed, GOP/Dem establishment the Donald, too. Read it all here: https://t.co/yGKTvR0Dkm pic.twitter.com/nTah1DSNxl

— David Stockman (@DA_Stockman) March 20, 2019

Reprinted with permission from David Stockman’s Contra Corner.